unrealized capital gains tax warren

Now that weve looked at what a tax on unrealized capital gains could be like its time to point out three significant. The proposal is likely dead on arrival as it doesnt have the votes in Congress but in its present form it would levy a 20 minimum tax on all income including not just realized.

Taxing Capital Gains At Ordinary Rates Evidence Says Do It So Does Buffett Jared Bernstein On The Economy

A tax on an increase in unrealized capital gains is only on the most stretched of interpretations a tax on income.

. This tax is similar to taxes that have long been supported by progressive lawmakers like Sens. And Senator Elizabeth Warren pushed a more sweeping version of an unrealized capital gains tax during her presidential run. Elizabeth Warren D-Mass and Ron Wyden D-Ore speak to reporters about a corporate minimum tax plan at the US.

26 2021 in Washington DC. Raising the rate is not going to cause Jeff Bezos. When a permanent income tax was.

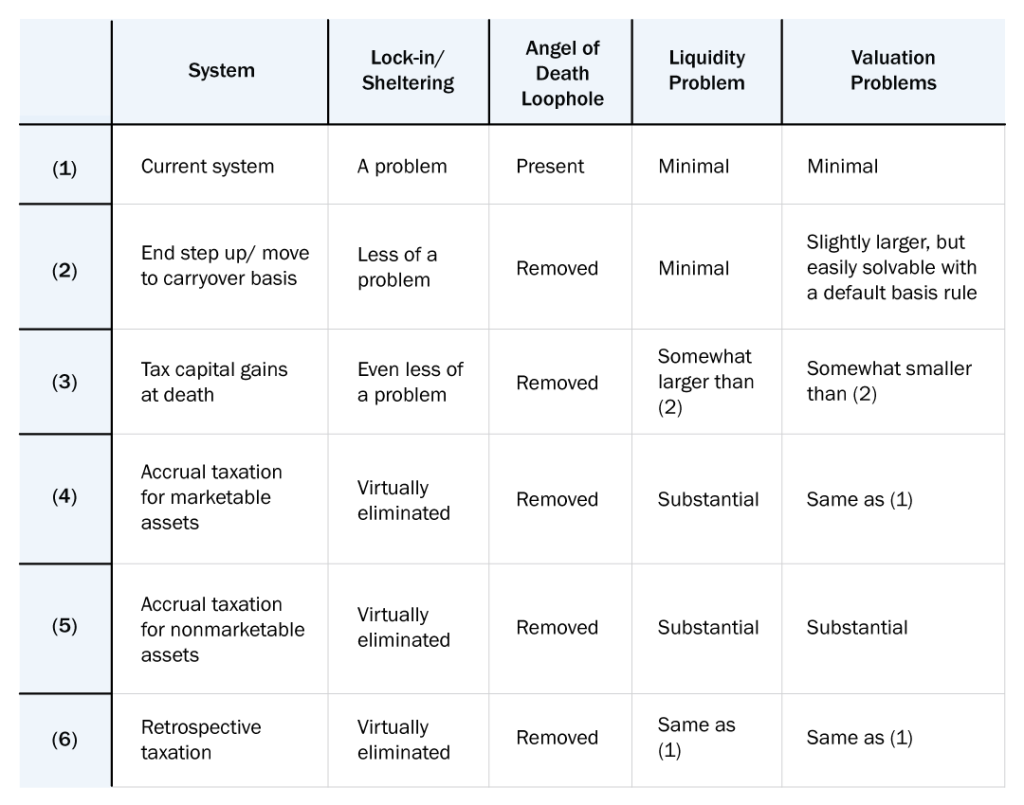

The amount youll pay in capital gains taxes depends primarily on how long you held an asset. The Problems With an Unrealized Capital Gains Tax. The new proposal would tax unrealized capital gains meaning that the wealthy would no longer be able to defer tax payments on gains made each year.

Third Congress should claw back the benefits of deferral from high-net-worth. This brings the total taxes paid on the 150 million profit to 1013 million for an effective tax rate of 68 percent and after-tax income of 487 million. If the proposal were.

Lets assume over the. Elizabeth Warren D-Mass and Bernie Sanders I-Vt. An unrealized capital gains tax on corporate assets could hit those with real estate especially hard but companies with bitcoin also come to mind.

Second Congress should repeal stepped-up basis and tax unrealized capital gains at death. Unrealized capital gains tax means if you buy a stock for 100 and it goes up to 500 then back down to 50 you owe taxes on the 400 profit you never made. In 2011 superstar investor Warren Buffett made headlines not for his investment recommendations but for his opinion.

Warren Buffett taxing capital income is a bad idea. If you hold an asset for less than one year and sell for a capital gain the.

Congress Should Reduce Not Expand Tax Breaks For Capital Gains Itep

Wilford Wyden S Breathtakingly Terrible Idea To Tax Unrealized Capital Gains The Daily Caller

Warren S 2 Cents Will Prove Costly For All Wsj

Short Term And Long Term Capital Gains Tax Rates By Income

Why Congress Shouldn T Rush To Enact Poorly Conceived New Taxes To Fund Spending Spree The Heritage Foundation

Warren V Sanders Whose Wealth Tax Is Harder On Billionaires

A Capital Gains Tax Hike Should Alter Your Income And Selling Strategy

Senate Dems Propose Capital Gains Tax At Death With 1 Million Exemption

What Are Unrealized Capital Gains And Losses Bright

Elizabeth Warren Slams Elon Musk Over Taxes National Review

Elizabeth Warren On Twitter Our Tax System Is Badly Broken That S Why Democrats Have A Plan To Raise Taxes On Millionaires And Billionaires The People At The Top Who Are Not Paying

The Billionaire Tax And A Wealth Tax Are Not The Same American Enterprise Institute Aei

Opposed To The Unrealized Capital Gains Tax R Elonmusk

What Are Unrealized Capital Gains And Losses Bright

What Are Capital Gains Taxes And How Could They Be Reformed

Will The Unrealized Capital Gains Tax Targeting Billionaires Pass

Trump S Fed Board Pick Stephen Moore Says Sen Wyden S Unrealized Capital Gains Tax Plan Is Horrific Fox Business

High Class Problem Large Realized Capital Gains Montag Wealth

The Meaning Of Income Suddenly Becomes Very Important For Tax Purposes Mish Talk Global Economic Trend Analysis